DCAT Week unpacked: What it all means for life science marketers in 2025

Held annually in New York City, DCAT Week brings together global leaders in the pharmaceutical manufacturing and supply chain sectors. Last month’s event saw those leaders return against a backdrop of big questions and even bigger expectations. The message coming out of the week was clear: the industry is evolving fast, and the landscape is complex. With topics spanning geopolitics, pricing pressures, and next-generation therapeutics, there was a lot to talk about.

Our CEO, Kate Whelan, and Group Account Director, Matt Dayman, were on the ground to connect with clients and garner the latest trends from across the sector. Here’s what they learned, and what it all means for B2B life science marketers in 2025 and beyond.

A complex global landscape

Industry reports and data suggest that the pharmaceutical industry hasn’t fully bounced back from the impact of the COVID-19 pandemic. Drug launches are underperforming, market access hurdles are rising, and regulatory shifts are complicating the route to commercialisation.

In IQVIA’s Pharma Industry Outlook session, much of the current slowdown was attributed to lingering post-COVID disruption: backlogged patient pathways, increased reliance on remote prescriptions, and access restrictions driven by Health Technology Assessment (HTA) policies.1,2 All of this is creating a drag effect on new product uptake.

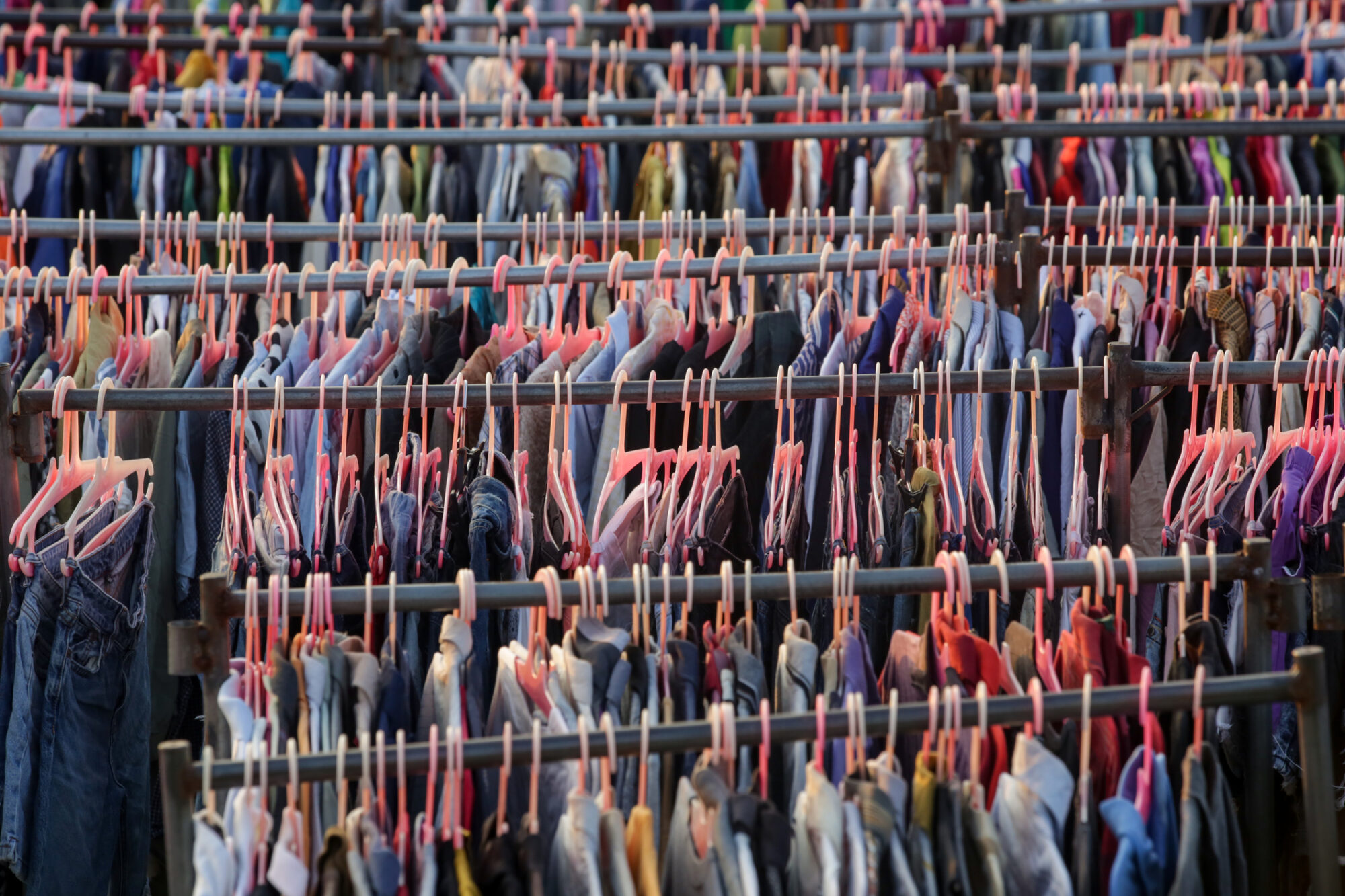

At the same time, the current geopolitical landscape is reshaping operational realities. The touted tariffs on APIs and drug manufacturing inputs in the US have the potential to raise operating costs and complicate global supply chains. With over 80% of US generics sourced overseas and $244 billion worth of pharma imports recorded in 2023, the consequences could be significant.3 Analysts anticipate regulatory approval delays, decreased capacity, and disrupted production timelines.3–5

Recent regulatory changes are having an impact in Europe, too.2 The implementation of new HTA regulations is slowing down crucial activities,6 while evolving wastewater policies could introduce cost burdens based on volume discharge.7 Taken together, these developments are forcing pharma companies globally to rethink everything from procurement strategies to portfolio planning.

Promising pipelines

Despite the growing complexity of the global pharmaceutical landscape, it is clear that innovation is as strong as ever.

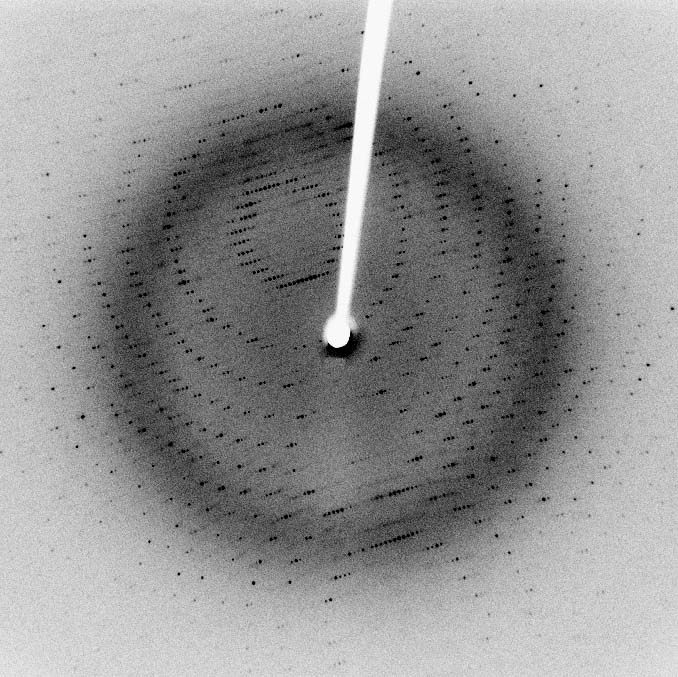

The number of products in clinical development continues to climb, but the proportion of oral solid dosages, traditionally the most common format, is decreasing. In fact, less than 40% of the 150+ products currently in development fall into this once-dominant category, highlighting the rising prevalence of biologics, injectables, and other less traditional delivery routes.3

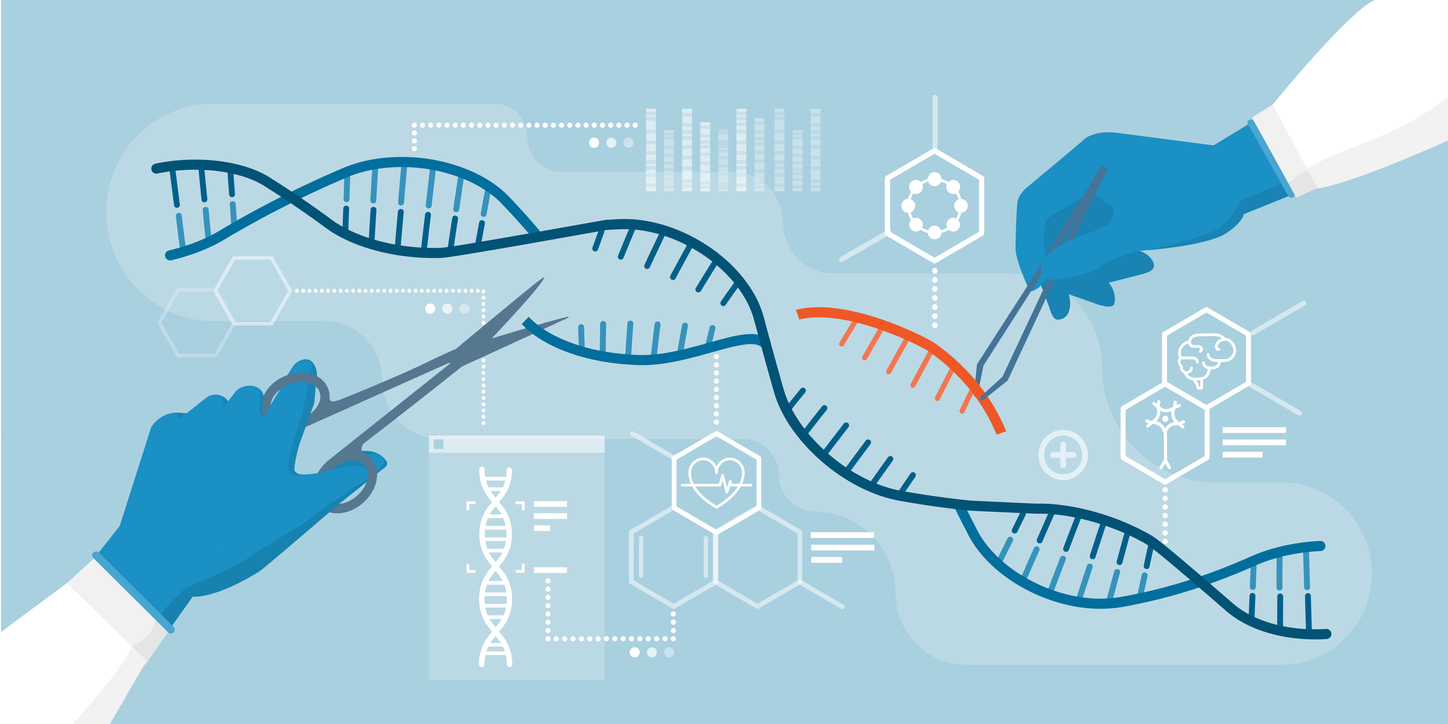

Antibody-drug conjugates (ADCs) have been showing a lot of promise, and now we’re seeing results. By delivering cytotoxins to cancer cells with increased specificity, these powerful drugs improve efficacy while reducing unwanted side effects. With 17 FDA-approved ADCs on the market and sales expected to top $10 billion this year, the modality is set to revolutionise cancer treatment.7

Taken together, these emerging modalities signal a profound shift in how we approach treatment and disease management. With oncology alone expected to see a $60 billion boost from these innovations by 2028,3 it’s clear that the future of medicine is not only bright, but fundamentally different.

Demonstrating value through marketing

One of the most important reminders to come out of DCAT Week is this: in a complex environment, marketing becomes even more critical.

As marketers, we need to reassert the long-term value of what we do. When budgets are tight, it’s tempting for companies to pull back on brand awareness, reduce strategic investment, or deprioritise messaging. But those short-term savings often come at a much greater cost. According to a recent Google report, for every $1 cut from marketing, companies need to spend $1.85 to recover lost ground in market share and brand equity.9

In life sciences especially, where trust, education, and differentiation are critical, a consistent and strategic marketing presence can’t be treated as optional. It’s what connects scientific breakthroughs with real-world impact. In an environment as dynamic as ours, that is more important than ever.

The reality is that pharmaceutical companies will have less to spend on marketing. So, to enable the development and dissemination of innovative new products, we life science marketers must be similarly innovative. We need to be flexible and adaptable, leaning into new tools to help us do more with less.

Artificial intelligence (AI), for example, is no longer just a buzzword, it’s becoming a core pillar of effective B2B marketing. These technologies offer a clear path to smarter, more efficient execution, but success will depend on how thoughtfully we apply them, combining digital precision with the human expertise that builds trust and drives long-term value.

At Notch, we believe that great marketing doesn’t just keep pace with change, it helps shape it. In a sector where complexity is the new normal and innovation never stands still, life sciences companies need strategic partners who can translate science into compelling, credible stories that resonate. Whether you’re navigating a challenging launch, evolving your brand strategy, or exploring new ways to optimise your marketing mix, we’re here to help. Get in touch to talk about how we can support your next big campaign.

References

- IQVIA (October 2022) Overcoming pharma’s launch performance problem. https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/iqvia-overcoming-pharmas-launch-performance-problem-wp-10-22-forweb.pdf

- Euractiv (November 2024) Europe’s pharma sector falling behind US and China – competitiveness drive is ‘urgent, vital’. https://www.euractiv.com/section/health-consumers/news/europes-pharma-sector-falling-behind-us-and-china-competitiveness-drive-is-urgent-vital/

- IQVIA Institute (2025) Global trends in R&D 2025. https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/global-trends-in-r-and-d-2025

- ING (April 2025) Trump tariffs on pharmaceuticals: What they mean for US consumers. ING Think. https://think.ing.com/articles/us-trump-tariffs-pharmaceuticals-consumers/

- CNBC (April 2025) Europe’s pharma industry braces for tariffs as carve-out hopes fade. https://www.cnbc.com/2025/04/02/europes-pharma-industry-braces-for-tariffs-as-carve-out-hopes-fade.html

- Pharmaceutical Technology (February 2025) EU reshapes HTAs – is the industry ready for it? https://www.pharmaceutical-technology.com/features/eu-reshapes-htas-is-the-industry-ready-for-it/

- Financial Times (March 2025) Pharmaceuticals under pressure: Europe’s evolving regulatory landscape. https://www.ft.com/content/8589fa20-3bf5-4704-b47b-489f1f1eeb30

- Biopharma PEG (February 2025) Antibody-drug conjugates (ADCs): Mechanism, benefits, and market outlook. https://www.biochempeg.com/article/427.html

- Google (June 2023) The Effectiveness Equation: Understanding the impact of marketing cuts on long-term brand health. https://services.google.com/fh/files/misc/google_report_the_effectiveness_equation.pdf